Spenda 2022: A year in review

Published: December, 20th 2022

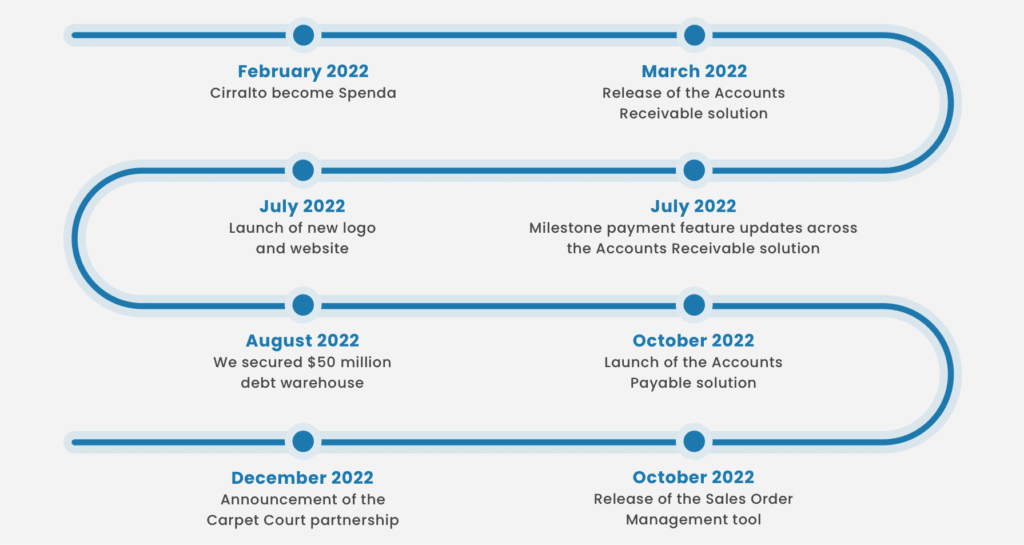

As another year comes to an end, we want to reflect on the past 12 months to highlight some of the great achievements our team has delivered. From a rebrand to the launch of a suite of game changing software solutions, we’re taking you with us on a trip down memory lane.

New look, same goal

In the first half of the year, we officially said goodbye to the name Cirralto, and we became known as Spenda. This was strategically done to create continuity between brand and product for our customers, investors, and staff.

Following this, in July we underwent a full rebrand which included a fresh new logo and UX design across our entire ecosystem. This was done to clearly reflect the evolution of the Spenda brand, whereby the new logo design represents the connected transfer of operational and financial data between businesses as they transact. We also launched our new website to match the rebrand and to showcase our growing breadth of capabilities in payments, software, and lending.

While we might look different to how we started the year, our mission: to help businesses boost operational efficiency and get paid faster; and vision: to drive improved cash flow and reduce payment friction across the supply chain, remains unchanged.

Product and customer developments

Over the year, our team continued to deliver unique solutions to the market, and in the last 12 months we have focused on developing and refining products across the Spenda ecosystem that both facilitate payments and lending, and deal with business elements that occur before and after the transaction event.

- By March we competed major enhancements to our invoice management offering with a slick and robust Accounts Receivable solution that gives businesses the infrastructure to manage their invoices and payments and deliver greater payment flexibility to their customers. This was swiftly followed by a series of key feature updates that makes getting paid a whole lot easier, including a Pay Invoice by Link feature, the ability for customers to make partial payments and an in-built live chat and dispute resolution function.

- In August, we solidified our position as a B2B lending solution provider when we successfully secured a $50 million debt warehouse that allowed us to deliver lending solutions to our customers. This was a key milestone in elevating our payments offering with working capital solutions that helps business strengthen cash flow and grow faster.

- The highly anticipated Accounts Payable solution was launched in October, and it did not disappoint. As a companion product to the Accounts Receivable tool, this product is a game changer for how businesses manage and pay their invoices. Not only does it reduce the traditional steps required to pay an invoice by more than 50 per cent, but it also has in-built security features that help prevent accounts payable fraud.

- The release of the Sales Order Management tool in October was another key milestone for us. This product gives businesses better control and transparency of their entire sales workflow, from quote to order, to delivery and payment.

- We capped the year off with an exciting customer announcement, sharing our partnership with Australia’s leading flooring retailer franchise network, Carpet Court. This partnership is a great example that shows the whole suite of Spenda services in action as a value-chain software solution. So far, we have successfully rolled out the Accounts Receivable, Accounts Payable and payment solutions into 20% of Carpet Court franchise network, with completion across all 205 stored expected within the first half of 2023.

Throughout 2022, we placed a major focus on implementing strict security and compliance measures. This work, while mostly driven behind the scenes, has fundamentally supported all our development work as we continue to offer customers a platform where they can accept and make secure payments with confidence. This included cementing a partnership with a world-leading authentication provider, Auth-0, implementing mandatory two-factor authentication, and continuing our 360-degree internal and external penetration testing to ensure our software safely supports the business needs of our growing customer base.

Our people

We credit all our achievements to our people as we would not be able to deliver these incredible highlights without them.

Our staff base is currently made up of 66 talented individuals, and we bring together a truly diverse team that originates from many different corners of the globe. This gives us a broad range of ideas and perspectives as we strive to create innovative solutions that aim to disrupt and change the way in which businesses trade with each other.

We continue to promote workplace flexibility and maintain a hybrid working model, allowing us to recruit and retain talented people in a highly competitive employment market. According to a Global Hybrid Work Study, two thirds of employees said workplace flexibility was most important to them, while 75 per cent of respondents feel more needs to be done across the board to embed hybrid work arrangements and reimagine the employee experience.

At Spenda, 88 per cent of the team are based near our key office locations across Australia and India, with the remainder working fully remote. Our flexible arrangements mean team members have the option to choose where and when they do their best work – whether that be in their home, at a café, in the office, or a combination of all.

As our business grows and evolves, we continue to place importance on workplace flexibility, equality, inclusivity, and diversity, and embed these practices in our recruitment process and into our working environment.

Looking ahead

We would like to thank everyone for their support over the last 12 months. We are looking forward to what the next year will bring and invite you all to continue on that journey with us.

If you ever want to learn more about us, please don’t hesitate to get in touch. If you’d like to be a part of the Spenda story, head on over to the Careers Page and check out our vacancies.

See you in 2023!