Blog

Common invoicing mistakes that lead to late payments and how to avoid them

Invoicing is a core component of your business that can either lead to stable cash flow or late payments.

How to know if your business is processing secure payments

With a more digital and connected world, we have seen a surge in the adoption of eCommerce technologies and contactless payments.

How to improve your accounts payable process and protect your business against fraud

Traditional payment processes are resource-heavy and time-consuming to manage. Digitising your Accounts Payable process will help secure your payments and save you time and money.

How to save money on merchant fees

Paying merchant fees might seem like the simple cost of doing business, but the recent surge in eCommerce means it is an area where businesses can save a significant amount of money.

Sales Order Management: How to better deliver on sales and convert orders to revenue faster

A Sales Order Management System is a digital solution that enables businesses to easily manage pricing, distribution, payments and tracking of shipments.

Invoice finance, explained: What it is and how it works

Cash flow is the lifeblood of any business, because with poor cash flow it ultimately becomes impossible for any business to function properly. When cash flow becomes tight, many tend to draw on other sources of funds – including banks and personal finances – just to stay on top of their bills.

Spenda in the Spotlight – Getting to know our Chief Credit and Risk Officer, Corrie Hassan

Chasing late invoice payments is a burden for any business, and still, more than half of B2B payments in Australia continue to be processed late, costing businesses, on average, $115 billion every year.

Spenda announces company rebrand

Today, Spenda, a B2B payment and lending solutions provider, has announced a full company rebrand that represents and aligns the continued evolution and growth of the business.

Common accounts receivable issues and what businesses can do to overcome them

Chasing late invoice payments is a burden for any business, and still, more than half of B2B payments in Australia continue to be processed late, costing businesses, on average, $115 billion every year

How businesses can leverage digital solutions to boost their cash flow and grow

Digital payments helped businesses get paid safely and efficiently throughout the COVID-19 lockdowns and associated restrictions. But as economies reopen many challenges still face businesses including supply chain disruptions, the ‘great resignation’, rising inputs such as fuel, and the expense of reopening. These business challenges make now an opportune time to build on the processes optimised throughout the pandemic, especially across B2B trade.

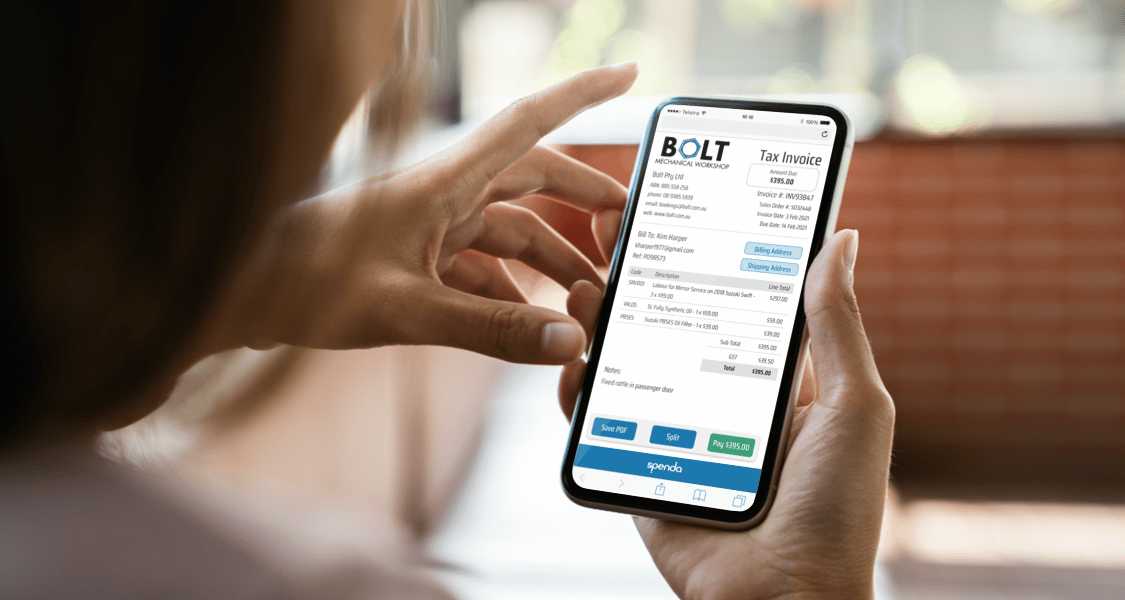

Pay Invoice by Link – What is it and how does it work?

In an increasingly cashless society, how can sellers easily and cost-effectively receive payment? One answer is using Pay Invoice By Link technology.

Five reasons to automate your accounts payable process

Automation helps businesses to realise efficiencies while providing a range of other benefits. If you’re like most businesses, accounts payables is likely an area that could benefit from automation to reduce manual processes and the need to manage each invoice one-by-one.