Subscribe to our blog

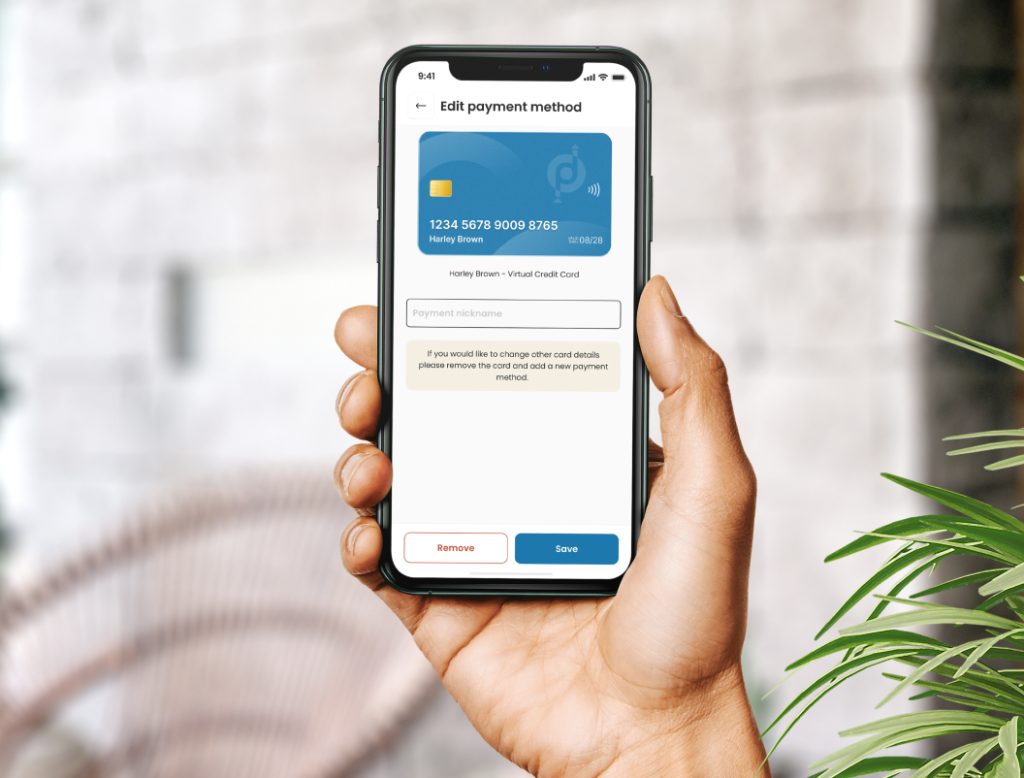

Virtual Credit Facility

Unsecured business loans

Use an unsecured line of credit, delivered through a virtual credit card, that gives you access to the cash your business needs to operate efficiently.

Fast, flexible and simple. Get the cash you need, when you need it.

Simple digital sign up

Complete our simple onboarding process and be approved for a credit limit in no time.

Scalable credit limits

Access up to 25% of your annual turnover, meaning your limits grow as your business grows.

Extended trade terms

Benefit from extended payment terms, accessing up to 90 days of additional working capital.

“Top-up” trade credit

An unsecured facility that can be used as “top-up” trade credit, as required, as an add-on to your existing borrowings.

Protect against fraud

Virtual cards are issued as needed, with no card data stored, meaning your business has better control of spending and is protected from fraud.

Improve your cash flow

Gain enhanced control over pending payments, customisable spending limits, and detailed transaction data. This results in efficient tracking and management of business expenses.

Make fast, secure payments

Prioritise security and compliance with industry-leading encryption technologies that adhere to strict data protection standards to ensure the security of transactions and sensitive information.

Access funds when you need them

Our Mastercard credit card product, backed by a third-party virtual card provider, offers an unsecured facility that can be used as “top-up” trade credit, as required, as an add-on to your existing borrowings.