Subscribe to our blog

Spenda: Looking back on 2023

Published: December, 27th 2023

As we close out 2023, let’s look back at another incredible year at Spenda. It’s been a whirlwind of exciting partnerships, major accomplishments, and innovative product updates, all shaping our journey. Now it’s time to head down memory lane and dive into the key achievements and pivotal moments that have brought us to where we are today.

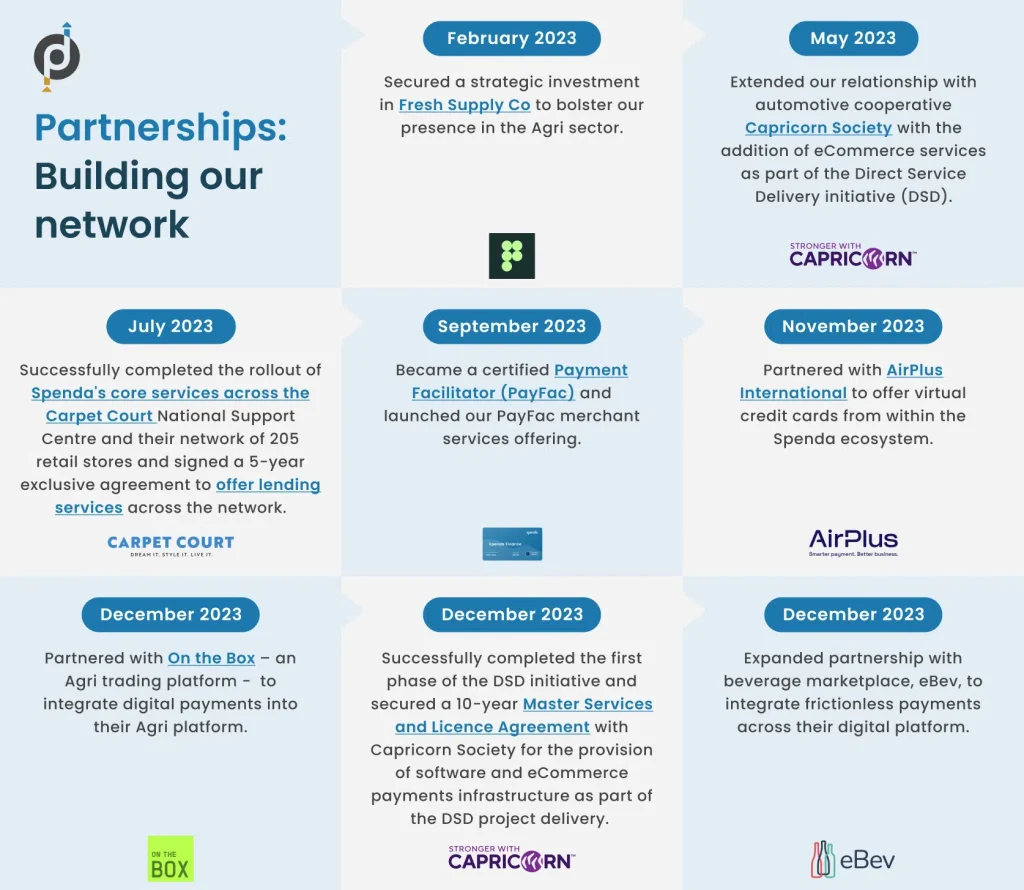

Partnerships: Building our network

This year was a landmark year for Spenda. We laid the groundwork for the future through key partnerships and launched products that continue to transform the way our customers do business. Here’s a snapshot of what we accomplished:

February 2023: Secured a strategic investment in Fresh Supply Co to bolster our presence in the Agri sector.

May 2023: Extended our relationship with automotive cooperative Capricorn Society with the addition of eCommerce services as part of the Direct Service Delivery initiative (DSD).

July 2023: Successfully completed the rollout of Spenda’s core services across the Carpet Court National Support Centre and their network of 205 retail stores, and signed a 5-year exclusive agreement to offer lending services across the network.

September 2023: Became a certified Payment Facilitator (PayFac) and launched our PayFac merchant services offering.

November 2023: Partnered with AirPlus International to offer virtual credit cards from within the Spenda ecosystem.

December 2023: Partnered with On the Box, an Agri trading platform, to integrate digital payments into their Agri platform.

December 2023: Successfully completed the first phase of the DSD initiative and secured a 10-year Master Services and Licence Agreement with Capricorn Society for the provision of software and eCommerce payments infrastructure as part of the DSD project delivery.

December 2023: Expanded our partnership with beverage marketplace, eBev, to integrate frictionless payments across their digital platform.

Product: Innovation behind the scenes

The partnerships and successes we achieved wouldn’t be possible without our software – the core of everything we do at Spenda. As part of our vision, we aim to provide true collaboration between businesses, removing the friction and barriers created by siloed software and instead, providing an ecosystem that delivers real value to both parties in a transaction.

Across 2023 we continued to enhance our product offering and introduced new features and services while also improving the performance of our core Accounts Payable and Accounts Receivable solutions. Key enhancements included:

- Integration of dispute management: Which allows customers to communicate and resolve order or invoice disputes in real-time with their supplier. This feature helps streamline the way claims and returns are managed, reduces response times, and helps to improves payment times.

- Integration of Buyer Finance into the Spenda ecosystem: This means customers can pay for invoices by accessing point-of-sale lending all from within their Spenda account.

- Ledger-to-ledger integration: Or tenant-to-tenant integration as we like to call it at Spenda, gives users the ability to seamlessly pass data securely between two separate businesses. This means both parties involved in any transaction are working off the same source of digital truth, which also helps combat the increasing threat of data tampering, fraud, and security risks.

- Improved transaction and fraud monitoring: Security is at top-of-mind at Spenda. As a result, we have implemented extra security features within our software to ensure both user data and payment data is kept safe and that only authorised users have access to their accounts.

- Automated testing: Which enables us to release features and upgrades at a much faster pace and contributes to the overall reliability of the Spenda software.

- Development of Spenda Wallet: A payment authorisation app and companion to our Accounts Payable solutions which enables users to securely approve invoice payments on the go. This product will be released on the App Store and Google Play in early 2024.

People: Strengthening our team

At Spenda, we know our success reflects the work of our incredible team. They are the driving force behind every accomplishment, milestone, and innovative step forward. This year, we strategically bolstered our team across all departments, enabling us to stay ahead of the curve and consistently deliver exceptional service to our customers and partners.

On top of this, we expanded our Board of Directors with the addition of payments expert, David Laird. His expertise and experience will be instrumental in guiding Spenda’s continued growth and expansion as a key player in the industry.

Looking forward to 2024

2023 has been a year of great challenges but of even greater successes, and as we look ahead, we remain committed to building upon the positive momentum achieved this year. We would like to thank everyone for the continued support, and we look forward to what the New Year will bring for us all.

See you in 2024!