Subscribe to our blog

Spenda Accounts Payable x Spenda Wallet: The faster and more secure way to pay invoices

Published: March, 26th 2024

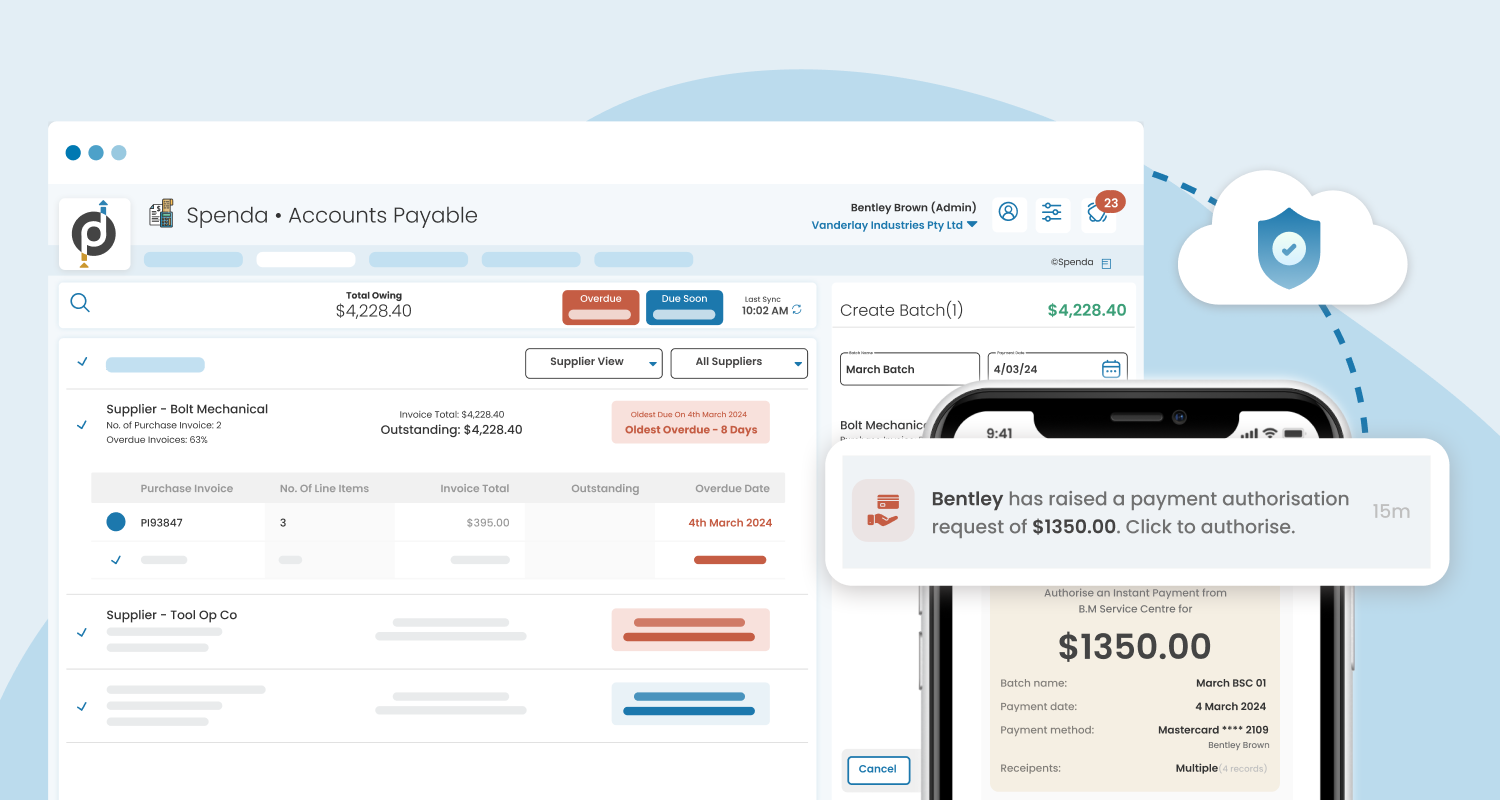

Introducing the improved Spenda Accounts Payable (AP) solution which comes equipped with a new self-guided set up, enabling users to easily onboard themselves and quickly streamline their payables. To complement this solution, we have also released a payment authorisation app, Spenda Wallet, and when used together, these two products not only speed up invoice payments but also deliver a comprehensive safeguard against accounts payable fraud.

Spenda Accounts Payable: Effortlessly manage supplier payments and drive stronger cash flow

Digitising and streamlining your accounts payable process means your businesses can reduce its invoice processing time by 74 per cent, leaving your team to focus on more strategic and meaningful work.

Key benefits of Spenda’s AP software include:

-

Protect your business against fraudulent transactions: By limiting the ability to tamper with ABA files, account and payment information, and assigning specific approval responsibility to employees, you will ensure that each invoice has gone through the appropriate checks before payment is released.

-

Increased accuracy: Digitising your processes means fewer hours (and costs) wasted on human resources needed for manual invoice processing. Reducing the likelihood of data-entry errors and removing potential duplicated payments.

-

Never recreate multiple versions of the same batch payment: When last minute invoices are added or removed from a batch. Simply make changes to batch payments during the review process by simply deselecting an invoice from a batch.

-

The ability to pay multiple suppliers in one place: Conveniently view and pay connected suppliers from one easy-to-use dashboard. Track, group, and batch-pay outstanding invoices with integration into your accounting software or via an ABA file upload to gain visibility on your outgoing payments.

-

Access more payment options: Have more flexibility in how and when you make payments with access to a variety of payment options, including split payments and the ability to pay via card, even if your supplier does not accept card payments.

- Quick integration: All transactions are fully integrated with your small business accounting software or larger ERP management systems. Use real-time data to make informed decisions, say goodbye to manual data entry errors, and stay on top of your cash flow.

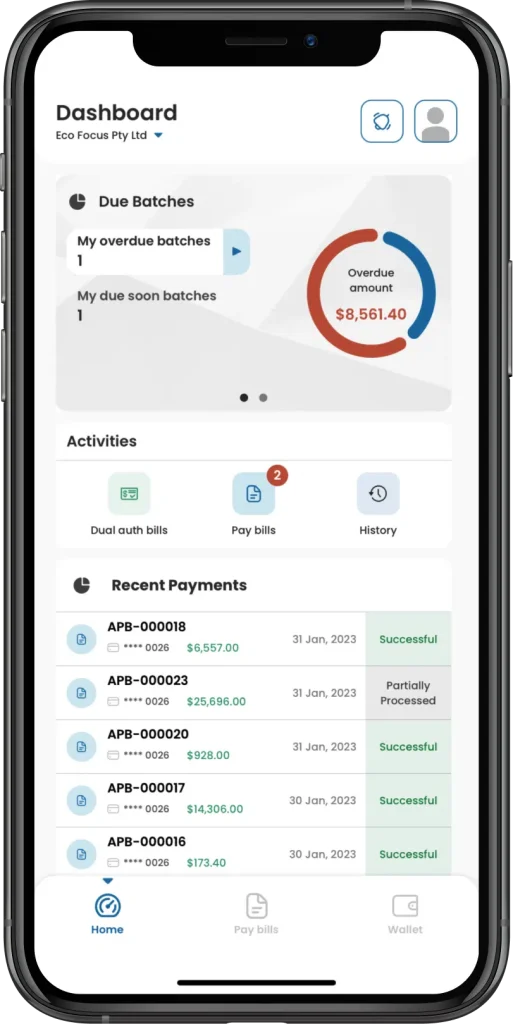

Spenda Wallet: Your go-to mobile payment authorisation application

With Spenda Wallet, your Accounts Payable team can unlock improved efficiency, security, and flexibility. This product is intended to support our AP software solution and enables authorised users to collaborate with their team in real-time and edit and approve invoice batch payments from their mobile device, wherever they are.

How it works

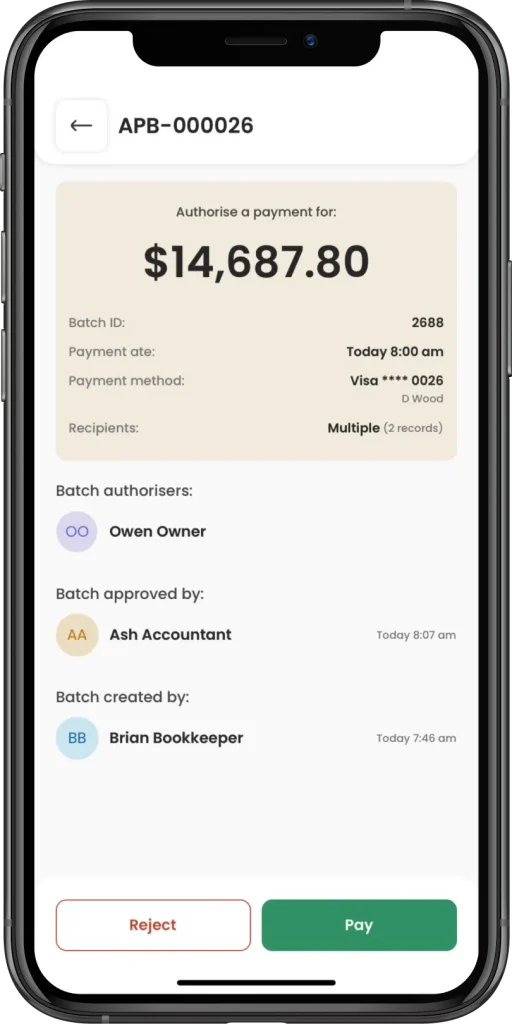

Step one

Access the Spenda Wallet app and navigate to your unpaid bills.

Step two

Select the required batch, review the payment details and click ‘Pay’.

Step three

For security purposes, enter the authentication code sent to your mobile.

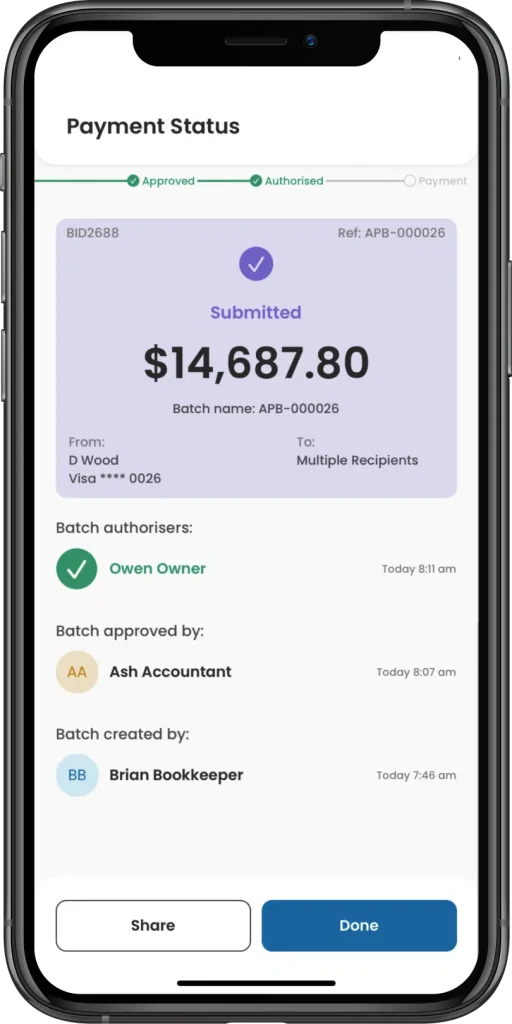

Step four

Your payment has been authorised and will be submitted.

With Spenda Wallet, businesses will be able to:

-

Fast-track approvals: Once your AP department sets up the payment batch, authorised users will receive personalised notifications on their mobile device, removing cumbersome approval emails and text chains.

-

Unlock more payment options: Approvers will receive a payment authorisation request notification and upon review they can choose to pay with a pre-configured payment option or add a new payment method.

-

Process secure payments: We have implemented a series of strict security layers, including biometric scanning and SMS code approvals, to ensure authorised users are identified correctly before approving payments. Create custom approval layers with the option to add multiple approvers with sequential approval settings.

Supercharge your accounts payable process with Spenda

By using Spenda’s AP and Wallet combination, your business will have better control of the payables process, saving you valuable time and effort, and ensuring payments are processed accurately and on time.

Set up a Spenda Accounts Payable account today and get 30 days free*

Download Spenda Wallet

NOTE: Spenda Wallet needs to be used in conjunction with a Spenda AP account. The payment will be triggered within the Spenda ecosystem, and the Wallet app will enable the payment authorisation.

*30 Days Free Promotion Terms & Conditions

By signing up, you are entitled to a complimentary 30-day trial of Spenda’s Accounts Payable software. This trial covers only software usage fees and excludes invoice payment processing fees. Following the trial period, you will be given the choice to upgrade to a paid account or to delete your account. Monthly software fees start at $250 per month. Enterprise fees are available on request.