Subscribe to our blog

Pay Invoice by Link – What is it and how does it work?

Published: March, 3rd 2022

In an increasingly cashless society, how can sellers easily and cost-effectively receive payment? One answer is using Pay Invoice By Link (PIBL) technology.

The COVID-19 pandemic has undoubtedly altered the way consumers engage with businesses. There is more online shopping than ever before and hygiene concerns have triggered a dramatic shift to contactless payments as the world sought new technologies to meet the global challenge.

What are contactless payments?

The term contactless payments captures any system that uses radio-frequency identification or near field communication to make a secure payment without the need to hand over a physical card during the payment process. Most people use contactless payments in their daily life, think tap and wave credit card and debit cards, smart cards and smartphones with digital wallets like Apple Pay, Google Pay or Samsung Pay.

Why are no-touch payments on the rise?

There is little doubt that the surge in contactless payments can be attributed to health and safety concerns brought about by COVID-19. The AFR reported that “cash-out” transactions with EFTPOS had dropped 70% as of mid-April 2020 compared to pre-COVID numbers. And MasterCard reported 91% of customers in Asia were now using contactless payment, citing safety and cleanliness as the driving factor.

The response to the pandemic may have pushed contactless payments to the forefront, but behind the trend are core benefits and software capabilities that provide convenience, security and a number of other benefits to both consumers and retailers.

PIBL is a powerful payment tool enabling businesses to take contactless payments from customers without the need for a credit card to be exchanged or even for the customer to be physically present. Other benefits include:

Improved security:

Protecting a consumer from sharing personal information with third parties and removing the need to hand over a credit card or provide sensitive payment information over the phone.

Enhanced customer experience:

Giving consumers a data-rich platform that provides them with convenience and ease of payment. Most contactless payment platforms are designed to make paying easy and fast, meaning businesses are paid quicker for goods and services rendered.

Reduce credit claims and refunds:

For businesses using an eCommerce solution, PIBL will reduce the instance of credit claims and returns. Once an order has been placed a confirmation is sent to the customer, but the payment collection process is not initiated until after the order has been picked and sent to packing. This stops consumers from paying for products that are not in stock and saves the business from having to spend valuable time issuing returns. This functionality is especially relevant given the current uplift in eCommerce sales across Australia.

Cut manual data entry:

Traditional remote payments place the onus on the consumer to both identify themselves to the business collecting payment and to ensure they are paying the correct value. PIBL removes the need for customers to enter an invoice number or quote a reference number through the provision of a data-rich environment that securely connects and identifies the buyer, seller and the transaction value.

How does it work?

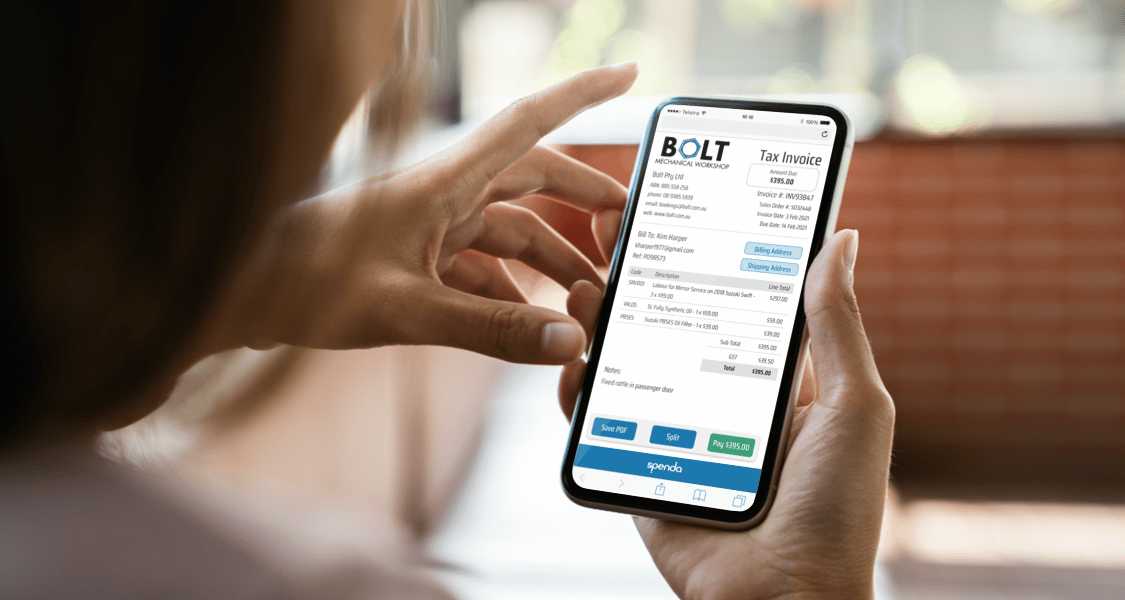

- Once an invoice has been raised, the customer is sent an email with a unique, secure link for payment.

- The customer clicks the link on their phone or computer, views the invoice and enters their preferred payment method, either credit card or bank account. These details are tokenised and saved to make future payments quick and easy.

- Once the customer processes a payment, the business is informed and the payment is sent to their nominated bank account. A transaction is then automatically posted to their accounting system.

Interested in using Pay Invoice By Link technology in your business?

PIBL has applications across many business segments, but is particularly relevant to:

Retail service businesses:

For businesses currently issuing paper invoices or chasing up payments once a job has been completed, PIBL can streamline the process and deliver a unique link to a customer at the point a job is complete, improving cash collection for businesses.

Retail businesses:

PIBL technology can be used to collect payment for products without a customer needing to be physically present in the store. It can also be used to facilitate instalment payments and has application to lay-by purchases.

eCommerce businesses:

For eCommerce businesses, PIBL can be integrated with an online store with a payment link sent securely to the customer once stock levels have been checked to ensure order fulfilment.