Subscribe to our blog

Blog

The digital CFO: How to lead your business to financial success

Effectively leading and expanding a business requires leaders to reflect on past performance to identify areas for improvement, while concurrently devising and executing strategies that drive sustained long-term growth.

How virtual cards are transforming B2B trade

In recent years, the increasing adoption of mobile wallets and contactless payments has made consumers more comfortable with paying without the need for a physical card. In B2B trade, virtual cards work in a similar way whereby businesses issue credit cards to their customers as an additional payment option.

Spenda integrations: Future-proof your accounting and make work easier

Seamless data flow is critical for efficient financial operations, regardless of the size of your business or industry.

How to transform your accounts payable function into a strategic powerhouse

For many years, accounts payable (AP) has been a cost centre in most businesses.

Taking supplier payments from transaction to transformation

For businesses across all industries, improved accounts payable and accounts receivable processes can deliver efficiencies that drive growth. This growth comes from upgrading payment systems and processes to improve productivity and strengthen cash flow.

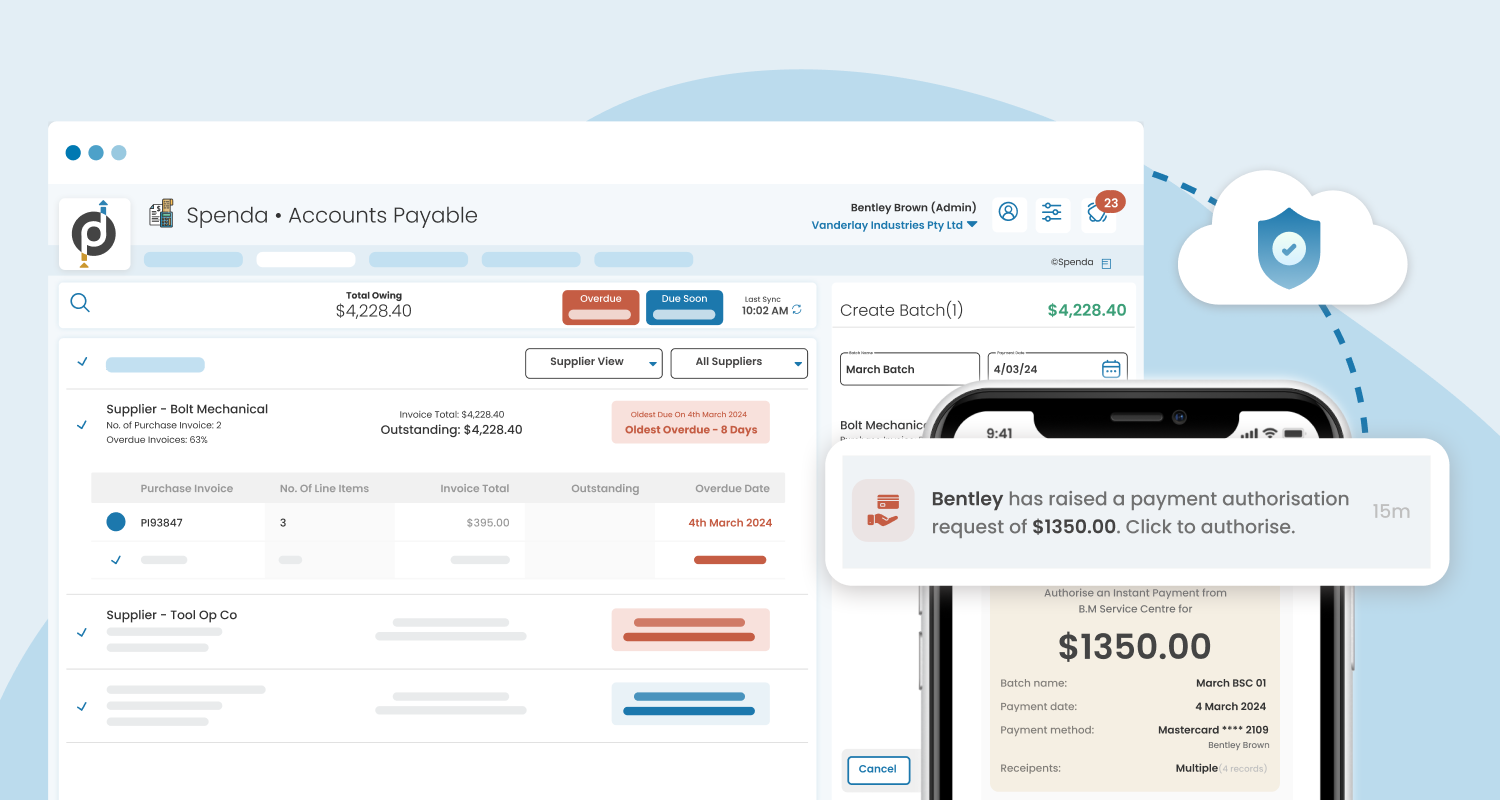

Spenda Accounts Payable x Spenda Wallet: The faster and more secure way to pay invoices

Introducing the improved Spenda Accounts Payable (AP) solution which comes equipped with a new self-guided set up, enabling users to easily onboard themselves and quickly streamline their payables.

How your business can use early settlement discounts to improve trading relationships

Having the ability to use ESD can boost everyone’s cash flow and improve trading relationships. Keep reading for an overview of ESD and how they work.

Technology may be advancing and changing, but the value of strong cash flow isn’t

Digital transactions and evolving financial technologies have dominated digital transformation in recent years. And while these developments are helping businesses to work smarter, cash flow management remains critical. The fundamental principles of monitoring cash inflows and outflows help businesses ensure that their finances are strong so they can meet their ongoing operating expenses and plan investments in growth.

How the right payment solution can drive growth and transform your supply chain

Despite the disruptions of recent years pushing businesses to move as much of their operations online as possible, friction still exists in business-to-business (B2B) payments. This friction causes late payments, has flow-on effects across the supply chain, and increases credit risk, particularly when companies rely heavily on trade credit to make sales.

Spenda: Looking back on 2023

As we close out 2023, let’s look back at another incredible year at Spenda. It’s been a whirlwind of exciting partnerships, major accomplishments, and innovative product updates, all shaping our journey. Now it’s time to head down memory lane and dive into the key achievements and pivotal moments that have brought us to where we are today.

B2B payments: What to expect in 2024

The accelerated transformation in B2B payments seen in the last three years is set to continue into 2024 and beyond. As businesses look for more efficient ways to make and take payments and even fund their operations and growth initiatives, digital B2B payment technology is proving to be an effective solution.

Not getting paid on time? It might not always be the customer’s fault

Payment technology has emerged as a pivotal force driving substantial change in accounting systems and processes. The pace of this change is prompting businesses to complete a comprehensive reevaluation of their financial transaction practices. From streamlining invoicing procedures to strengthening cash flow management, innovation in payment technology is not only revolutionising financial processes but also significantly reshaping the professional landscape for accounting professionals. This article delves into the influence of tech-driven payment solutions on the accounts receivable and accounts payable functions, and its impact on employee productivity and engagement. Keep reading to learn more.