Press

Spenda, Limepay partner with Lessn to boost payment capabilities

Integrated business platform that allows companies across the supply chain to sell and get paid faster, Spenda, and its acquiree company, Limepay, have recently partnered with Lessn.

The ROI of speed: How integrated digital solutions can expedite the payment cycle

Bringing in new business, extending credit to new customers, and delivering exceptional products and services all contribute to driving revenue growth.

The digital CFO: How to lead your business to financial success

Effectively leading and expanding a business requires leaders to reflect on past performance to identify areas for improvement, while concurrently devising and executing strategies that drive sustained long-term growth.

Five Fintechs on Friday

Fintech Australia selected Spenda as one of five fintech companies you need to know

How to transform your accounts payable function into a strategic powerhouse

For many years, the primary role of accounts payable (AP) has been to make payments to suppliers, employees, contractors, and any other person or business who was owed money.

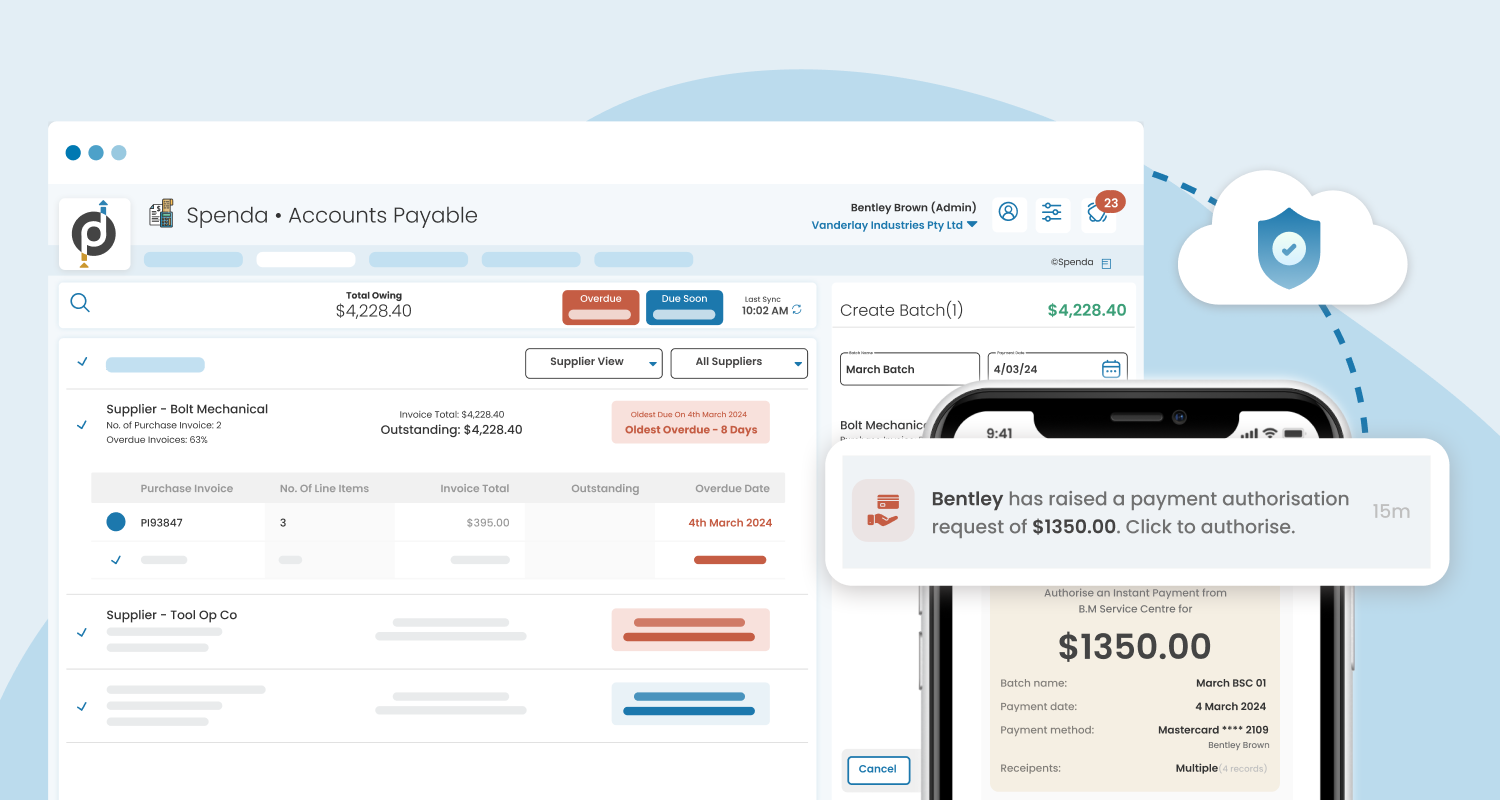

Spenda Accounts Payable x Spenda Wallet: The faster and more secure way to pay invoices

Spenda, a leading B2B software and payment solution provider, has announced a significant upgrade to its Accounts Payable (AP) solution.

Technology may be advancing and changing, but the value of strong cash flow isn’t

Digital transactions and evolving financial technologies have dominated digital transformation in recent years.

How the right payment solution can drive growth and transform your supply chain

Despite the disruptions of recent years and the move of many operations online, friction still exists in business-to-business (B2B) payments.

Spenda and eBev Partner on Integrated Payments Solutions for Marketplace

Spenda has partnered with eBev to provide integrated payments solutions across the eBev marketplace.

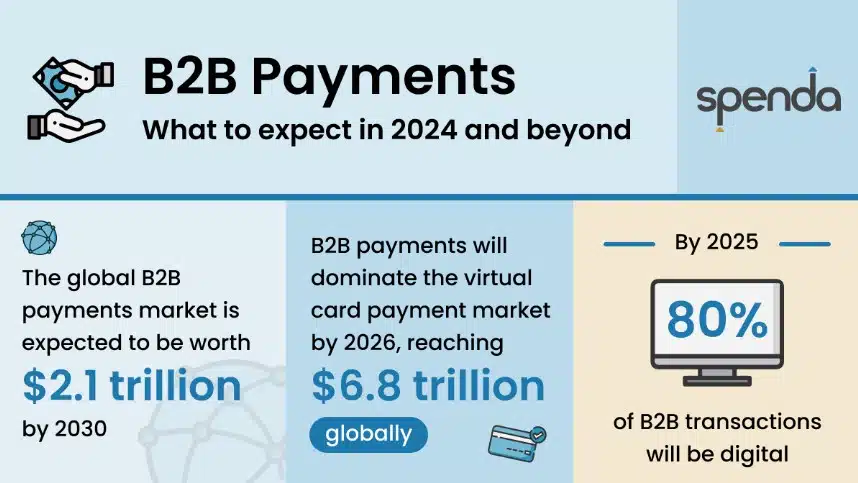

B2B payments: What businesses can expect in 2024 and beyond

As businesses look for more efficient ways to make and take payments and even fund their operations and growth initiatives, digital B2B payment technology is proving to be an effective solution.

On the Box selects Spenda to integrate digital payments into their agri platform

Spenda is pleased to announce that it has entered into a partnership with On the Box, a website for agents and vendors to buy and sell commercial cattle, sheep, goats and machinery.

How to drive growth across your franchise network

Your franchise network likely has strong systems and processes to ensure that your franchisees have everything they need to succeed. But if you’ve had these systems in place for a number of years, it could be hampering growth across the network.