Press

On Strategy, Execution, and What’s Next for Spenda: Q&A with Karim Razak, Executive Chairman

It’s been almost two months since Karim Razak joined Spenda’s Board, bringing with him a unique blend of entrepreneurial experience, operational insight and longstanding shareholder perspective.

What happens when you pay late? The cash flow domino effect explained

A late payment might seem harmless, but for the business waiting on that cash, it can be the difference between growth and going under.

10 trends shaping payments in 2026

Technology, new regulations, and rising customer expectations are reshaping how money moves. As we head toward 2026, Spenda have released ten trends that will play a big role in how companies manage, send, and get paid – making payments faster, smarter, and more connected than ever.

Spenda’s new Interim CEO Corrie Hassan sets a clear agenda: laser-focused execution and operational discipline

Corrie Hassan discusses her priorities as CEO, the value of her operational background, and what sharper execution means for Spenda.

Spenda announces leadership transition as managing director resigns

managing director and CEO Adrian Floate has resigned from his role due to personal health reasons. The board thanked him for a decade of leadership that steered the company through its IP commercialisation strategy and the global pandemic and culminated in ...

The hidden cost of manual business payments: How much is it really costing you?

Manual payments are slow, error-prone and hard to scale. Every time someone checks an invoice, enters payment details, verifies bank accounts and logs the transaction, it takes time.

Spenda targets $36.1 billion Australian B2B payments market with scalable platform

Spenda’s platform addresses several common pain points in B2B transactions, providing several key solutions: End-to-end digital workflow: Automating processes from quote to invoice, payment and reconciliation.

Spenda executes technology and funding agreement with APG Pay

Spenda Limited have announced that it has executed a Technology Services Agreement with APG Pay Pty Ltd, a wholly owned subsidiary of Singapore based APG Tech Pte Ltd to develop and commercialise a closed-loop corporate credit and payments platform.

Five FinTechs on Friday, June 13, 2025

Spenda simplifies business operations by bringing quotes, order management, invoices and payments into one easy-to-use platform. No more jumping between systems or drowning in admin. It’s all about saving time, cutting costs, and keeping things running smoothly, so teams can focus on what they do best.

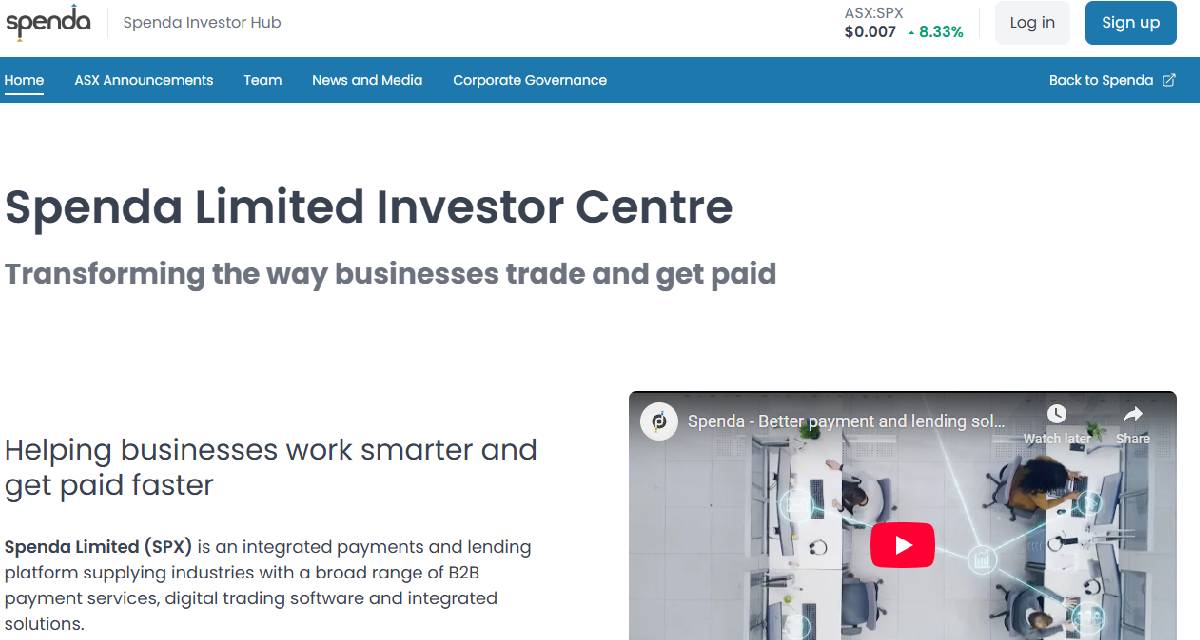

Spenda launches interactive Investor Hub communication platform for shareholders

ASX-listed Spenda Limited have announced that the launch of a new and interactive Investor Hub for dedicated investor engagement. The Investor Hub enables Spenda shareholders, stakeholders, and prospective investors to learn more about the Company’s activities and communicate with the company’s leadership team directly.

6 trends shaping business payments in 2025

The business payments landscape is changing fast and will continue to do so across 2025. As quicker and more efficient payment solutions become the norm, several key trends are transforming business-to-business (B2B) transactions.

Practical ways to strengthen small business cashflow

In this article, we discuss how businesses can use non-traditional unsecured business loans to improve their cashflow management, access funds quickly without collateral, and address various financial needs with greater flexibility. Keep reading to learn more.