10 trends shaping payments in 2026

Published: January, 27th 2026

Technology, new regulations, and rising customer expectations are reshaping how money moves. As we head toward 2026, these ten trends will play a big role in how companies manage, send, and get paid – making payments faster, smarter, and more connected than ever.

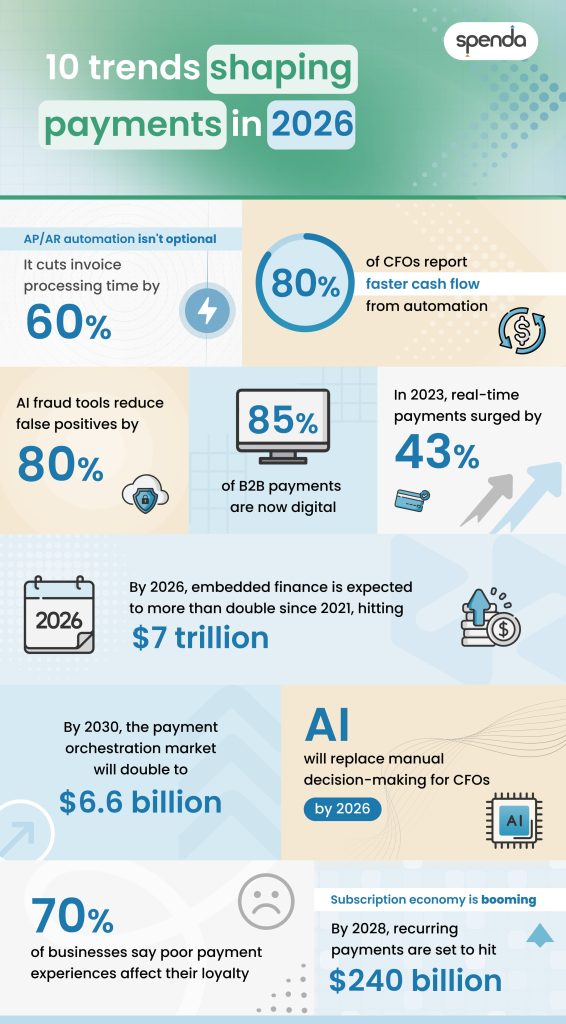

1. AP/AR automation is no longer optional

Manual accounts payable (AP) and accounts receivable (AR) processes are rapidly disappearing. Automation is now a must-have for efficiency, compliance, and resilience in a remote/hybrid work world.

• The global AP & AR automation market is projected to reach $2 trillion by 2033

• Automation reduces invoice processing time by over 60 per cent and improves cash visibility by more than 50 per cent

• 73 per cent of finance departments are using automation tools to streamline workflows

2. Embedded finance becomes business-as-usual

Embedded finance is now a multi-trillion-dollar global reality. By 2026, embedded financial services – including payments, lending, and banking – are projected to exceed $7 trillion in transaction value, more than doubling from 2021.

Expect to see more:

• In-app credit and extended trading terms for B2B buyers

• Integrated supplier payments and payroll

• Frictionless onboarding with KYC/AML checks built into the user flow

This shift is making financial services more accessible and seamless for businesses and their customers.

3. Virtual cards continue to expand in B2B

Virtual cards are rapidly moving from consumer to corporate use, and we expect this momentum to continue across 2026 and beyond.

• Digital payments now make up over 85% of B2B transactions in many advanced markets

• Virtual cards in B2B are growing at over 17 per cent Compound Annual Growth Rate (CAGR)

• Commercial card spend is projected to grow by 30 per cent between 2023 and 2028

Benefits include enhanced spend control, fraud protection, and streamlined reconciliation tied to card usage policies.

4. Real-time payments go mainstream

Real-time payments are now a global standard. In 2023, real-time payments accounted for 266 billion transactions worldwide, a 42 per cent year-on-year increase. By 2028, this figure is expected to surpass 25 per cent. Businesses can expect:

• Faster reconciliation and improved liquidity visibility

• Suppliers demanding instant settlement, often in exchange for early-payment discounts

5. There’s a greater focus on cash flow intelligence

Finance teams are moving beyond static balance tracking. Globally, AI-powered cash flow forecasting, scenario planning, and predictive analytics are now essential. This intelligence is crucial for navigating economic uncertainty and making smarter financial decisions.

• AI tools can reduce forecasting errors by up to 50 per cent

• Automated cash flow intelligence helps identify risks, optimise payment terms, and improve working capital

• Over 80 per cent of CFOs report that automating payment operations has reduced payment delays and improved overall cash flow

6. Subscription payments and recurring billing evolve

The subscription economy is booming worldwide. The global recurring payments market is set to grow to $240 billion by 2028, with B2B models accounting for more than half of the market. Businesses are:

• Adopting advanced subscription management platforms for complex billing cycles

• Offering flexible payment options (monthly, usage-based, hybrid)

• Leveraging AI to predict churn and optimise renewals

This evolution is making it easier for companies to grow predictable revenue and deliver better customer experiences.

7. B2B payments expect consumer-grade UX

Business buyers expect the same speed, simplicity, and transparency they get as consumers – and over 70 per cent say a poor payment experience affects their loyalty. That means businesses need to make payments easier, faster, and more user-friendly. Think:

• One-click payments and mobile-friendly portals

• Self-service options for invoices, disputes, and payment tracking

• Personalised payment experiences based on buyer history and preferences

8. AI will be used for fraud prevention and compliance

AI is now essential for safeguarding payments and reputation. With cyber threats rising, most financial institutions believe AI will become the primary tool for fraud prevention in payments within five years.

• The use of AI in payment card fraud detection can reduce false positives by up to 80 per cent

• Over 60 per cent of financial institutions report significant improvements in fraud detection accuracy after implementing AI

9. Payment orchestration will drive more cost-efficient transactions

Businesses are turning to smarter platforms to manage all their payment methods in one place. This approach, known as payment orchestration, helps streamline the entire payment process. The market for these tools is growing quickly from $2.99 billion in 2025 to an expected $6.63 billion by 2030.

• Automatically choose the best way to process each payment

• Help spot and stop fraud

• Give finance teams a clear view of what’s happening

The result? Lower fees, fewer failed payments, and better control over cash flow.

10. The CFO will become a payments strategist

The CFO’s role is transforming. By 2026, CFOs will spend more time analysing and validating AI-generated decisions than making manual ones. Payments strategy is now a lever for:

• Improving cash flow and reducing costs

• Enhancing supplier and customer relationships

• Leveraging embedded finance and real-time insights to blur the lines between operations, treasury, and strategy

CFOs who embrace these trends will drive growth and resilience in a rapidly changing world.

Looking ahead

The payments space in 2026 will be shaped by faster transactions, smarter tools, and more automation. Businesses that stay on top of these changes will be better equipped to manage cash flow, reduce costs, and grow with confidence.

Spenda helps make that possible. Its platform brings together payments and business software in one single platform – making it easier to create quotes, send invoices, track payments and manage cash flow.

Spenda serves as both a software solutions provider and a payment processor, delivering essential infrastructure to streamline business processes before, during, and after the payment event. Their connected platform replaces multiple disparate systems with one collaborative solution, improving transactional efficiency between businesses.

This article is for general information purposes only. Consult a qualified financial advisor regarding any changes to or decisions about your business’s finances.